Key Differences Between Virtual Currencies and Physical Coins

What Makes Virtual Currency So Different?

Picture this: you’re holding a shiny quarter in your hand, its smooth edges and engraved design connecting you to centuries of tangible trade. Now, imagine instead a digital wallet, your balance visible only on a screen—intangible yet powerful. That’s the magic and mystery of virtual currencies. But how exactly do these worlds differ?

For starters, virtual currencies like Bitcoin or Ethereum exist entirely online. Unlike the coins jingling in your pocket, they have no physical form. You can’t feel a Bitcoin between your fingers or stack it on a counter. Instead, it lives on blockchain technology—a decentralized, secure ledger that keeps track of every digital transaction. On the other hand, physical coins are minted by governments, with designs steeped in national identity and history.

Here’s where it gets fascinating:

- Virtual currencies rely on cryptography and algorithms; physical coins lean on trust in central banks.

- While your quarters might weigh down your wallet, virtual currencies travel light—accessible from anywhere with an internet connection.

- Physical coins can wear out over time; digital currencies exist forever but fluctuate wildly in value.

Which side are you drawn to so far? The timeless feel of a coin between your fingers, or the futuristic thrill of a currency that only exists in ones and zeros?

Historical Context and Evolution of Money

From Barter to Precious Metals: The Dawn of Money

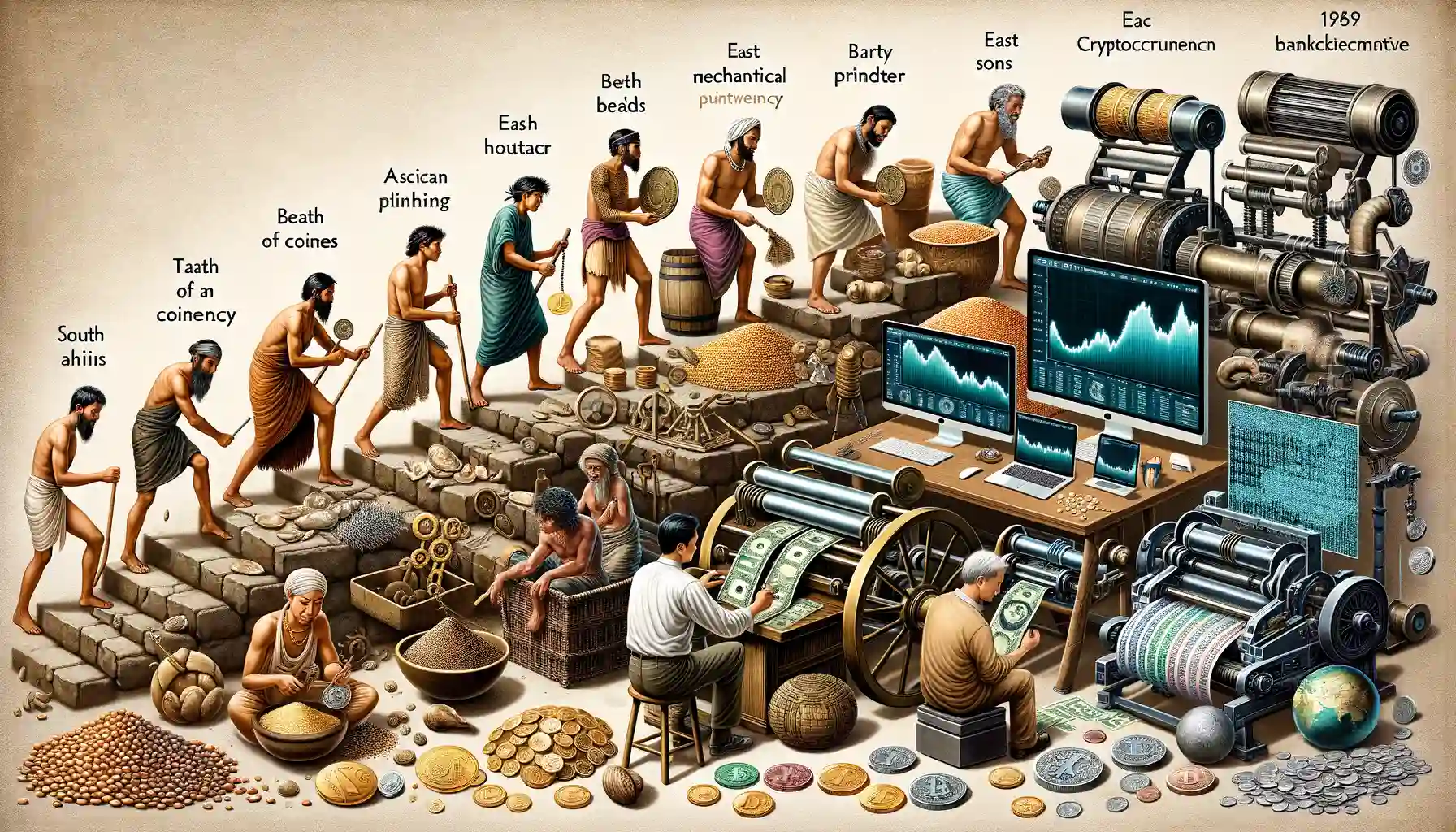

Imagine a world without money—where every transaction required a trade. That’s how it all began, in the era of barter systems. If you wanted a loaf of bread, you might’ve had to offer your neighbor a chicken or a basket of apples. But what happens when they don’t want apples? Cue the invention of money—a universal medium that simplified everything.

The earliest forms weren’t coins or digital balances but rather items of value: shells, beads, or even stones like the massive Rai stones in Micronesia. Then came the game-changer: precious metals. Gold and silver were shaped into coins, stamped with authority by kings to guarantee their weight and authenticity. Suddenly, trust was attached not just to the object but to the institution behind it.

Paper, Plastic, and Pixels: The Journey to Today

Fast forward centuries, and we’re unmistakably further down the road of innovation. Paper money replaced coins, introducing convenience and lighter wallets. Then came credit cards—a rectangle of plastic that transformed spending into something nearly magical. But today, we’ve reached a tipping point. Enter virtual currencies, like Bitcoin, which appear less like “money” and more like lines of code working on blockchain systems.

Think about it: What started as a handful of coins has evolved into invisible numbers on our phones. Coins jingle; virtual wallets beep. It’s progress, but also a shift that challenges how we perceive value, security, and even ownership. What’s next on this journey? Well, the future seems to be unwrapping itself byte by byte.

Advantages and Disadvantages of Virtual Currencies

The Bright Side of Virtual Currencies

Dive into the world of virtual currencies, and you’ll quickly see why they’re capturing the imagination of tech enthusiasts and financial pioneers alike. One major draw? Their unparalleled convenience. Imagine sending money to a friend across the globe in seconds—no banks, no business hours, just instant transactions. And let’s talk freedom. With blockchain-based cryptocurrencies, you control your funds directly. No middlemen, no freezing of accounts.

Another charm lies in their ability to shatter borders. Whether you’re shopping with Bitcoin in Tokyo or tipping an artist online using Ethereum, virtual currencies thrive in a truly global ecosystem. Oh, and the privacy factor. Many digital coins prioritize anonymity, keeping prying eyes far from your finances.

- Decentralization: Cryptocurrencies bypass traditional banking systems.

- Security: Blockchain technology protects against fraud and tampering.

The Flip Side: Challenges to Navigate

But let’s not sugarcoat it—virtual currencies have their flaws. They can swing wildly in value, making a climb feel like a roller coaster ride. The promise of high returns? It comes with equal risk. And then there’s adoption. While crypto fanatics might pay for coffee with Bitcoin, most cafes still prefer cold, hard cash.

Additionally, regulatory uncertainty creates a cloud of doubt for many traders and businesses. What happens if a government clamps down on crypto tomorrow? Lastly, let’s address the elephant in the room: energy consumption. Some blockchain networks, like Bitcoin, gobble up more electricity than entire countries, raising environmental concerns.

For all their futuristic glitz, virtual currencies are a balancing act—enticing yet challenging, revolutionary yet imperfect. Would you embrace the leap, or does the unpredictability hold you back?

Use Cases and Practical Applications

Everyday Scenarios for Virtual and Physical Money

Picture this: it’s Saturday morning, you’re craving your favorite coffee, and the line is moving fast. You whip out your smartphone, scan a QR code, and boom—payment made. That’s the magic of virtual currencies. No fumbling for coins, no waiting for change. But now flash forward—it’s the flea market next weekend, where cash is king. Those antique sellers? They probably don’t take Bitcoin. You dig into your wallet, fingers brushing the cool metal of physical coins, and feel that satisfying jingle as you hand them over. Each type of money shines in its own way, depending on where you are and what you need.

Who Benefits Most?

Virtual currencies have unlocked doors for some truly transformative uses. Want a glimpse?

- Travelers: Forget juggling exchange rates or currency converters—crypto is borderless.

- Small business owners: Lower transaction fees mean keeping more of their hard-earned income.

- Tech-savvy investors: Crypto trading has become their modern-day treasure map.

On the flip side, physical coins deliver practicality in ways digital wallets simply can’t. From vending machines to kids’ piggy banks, the humble coin still holds its place. And let’s not forget how it connects us to history—each one tells a story etched in its design. Whether shiny or scuffed, there’s almost an emotional weight to holding them.

Future Outlook and Implications for the Economy

The Ripple Effect on Global Markets

The rise of virtual currencies isn’t just a technological revolution—it’s an economic earthquake with aftershocks that could reshape industries, governments, and financial systems. Imagine a world where financial transactions are as seamless as sending a text message, bypassing the clunky bureaucracy of traditional banking. That’s not sci-fi; it’s happening now.

Virtual currencies, like Bitcoin or Ethereum, have the power to democratize access to capital. For small businesses in remote corners of the world, this means no more jumping through hoops to secure loans or paying exorbitant fees just to move money. Meanwhile, physical coins—those jingling relics in your pocket—continue to anchor economies reliant on cash-based transactions, especially in regions where digital infrastructure remains inconsistent.

Some likely ripple effects?

- Redefined taxation systems: Governments may shift how they collect and track revenue.

- Monetary policies in flux: Central banks might face difficulties in controlling economies tied to decentralized currencies.

And here’s the kicker: as trust shifts from physical currencies to blockchain-backed systems, traditional banks might need to double down on innovation—or risk fading into irrelevance. Are we ready for that? Only time will tell.

The Human Element in a Digital Future

While virtual currencies spark excitement, they also carry a fair share of anxiety. Money, after all, is deeply personal—it fuels our aspirations, secures our futures, and ties us to our communities. The adoption of digital currencies demands a colossal leap of faith: Can we trust something we can’t see or touch?

Think about rural farmers, factory workers, or the elderly who’ve grown up handling tangible cash. For them, the disappearance of physical coins might feel like the vanishing of stability itself. At the same time, younger generations—digital natives—are diving headfirst into crypto wallets and decentralized finance apps, embracing the chaos.

So, where does this leave the economy? In a tug-of-war between tradition and progress. Striking a balance will mean ensuring accessibility while keeping those without digital access firmly in the loop. Because as shiny as the promise of virtual currency is, an economic future that leaves people behind isn’t much of a future at all.